Out of control property taxes and unfairness!

74% of businesses agree municipal governments are NOT PAYING ATTENTION to small businesses.

Property tax fairness is getting worse!

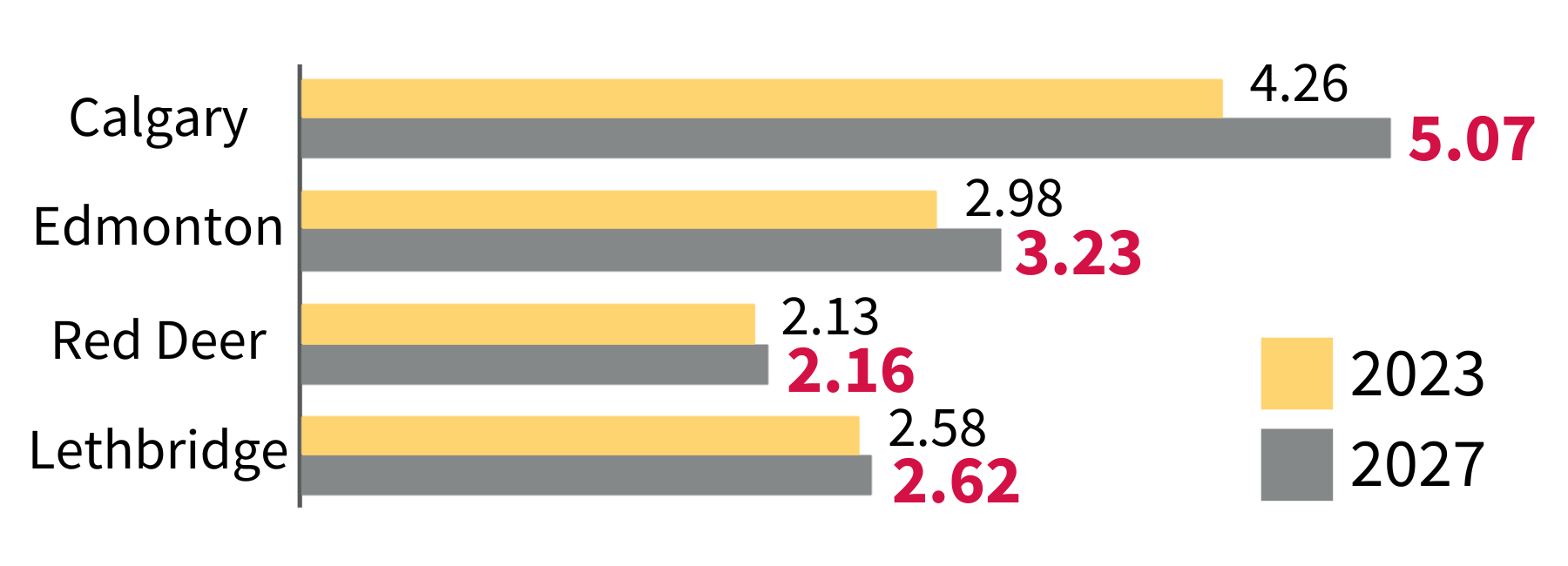

Property Tax Fairness Ratio* for Four Major Municipalities in Alberta

* Small businesses are greatly impacted by the spending decisions of municipal governments because they pay a disproportionate share of property taxes in their communities. The “property tax fairness ratio” is a measure of the difference of what commercial properties are assessed at versus the share of property taxes that commercial properties pay. A fairness ratio greater than 1 indicates unfavourable treatment for businesses, where the commercial portion of the property tax share is greater than the commercial portion of the property assessment share.

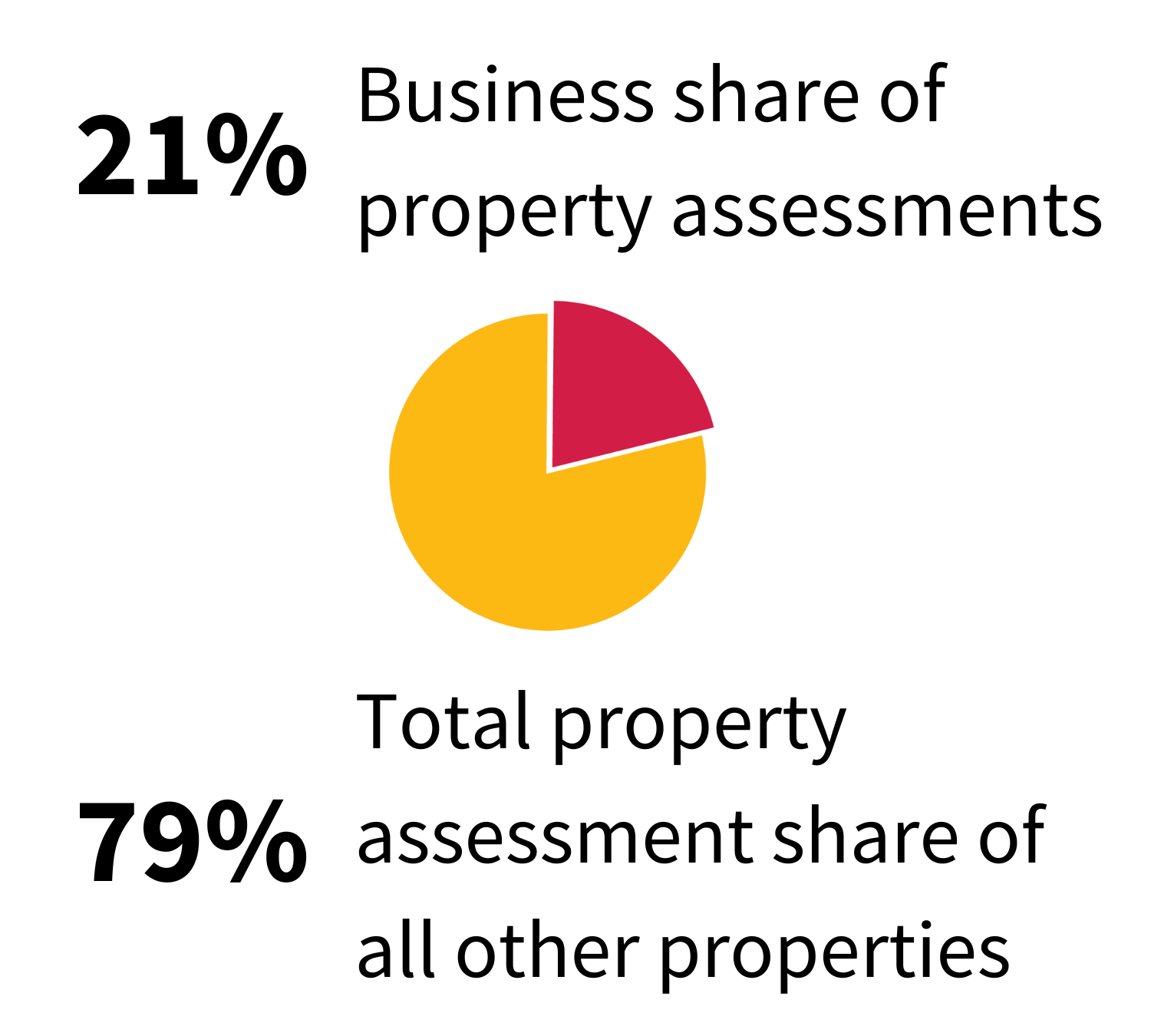

Businesses make up 21% of property tax assessments.

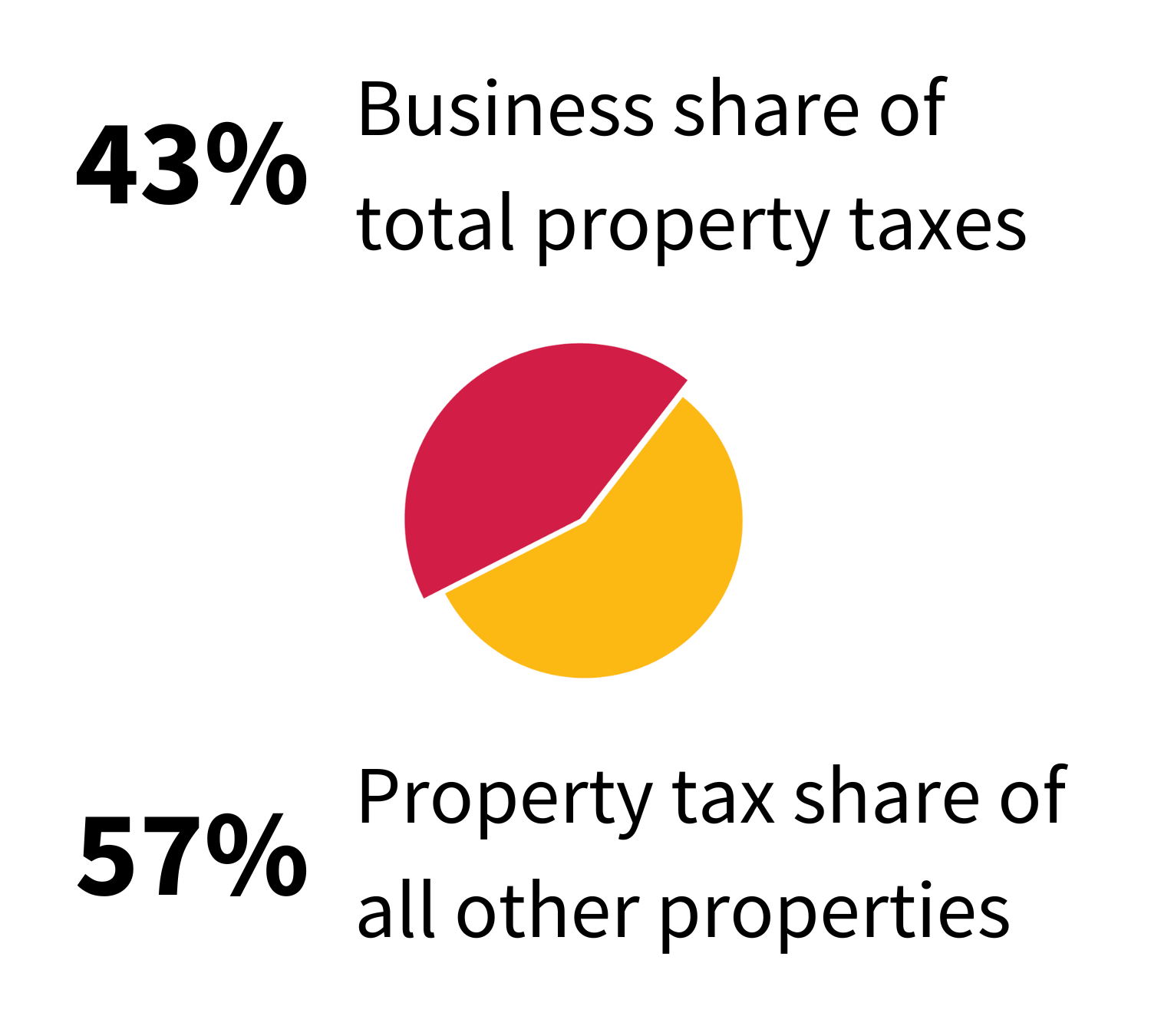

BUT they pay 43% of the property taxes.

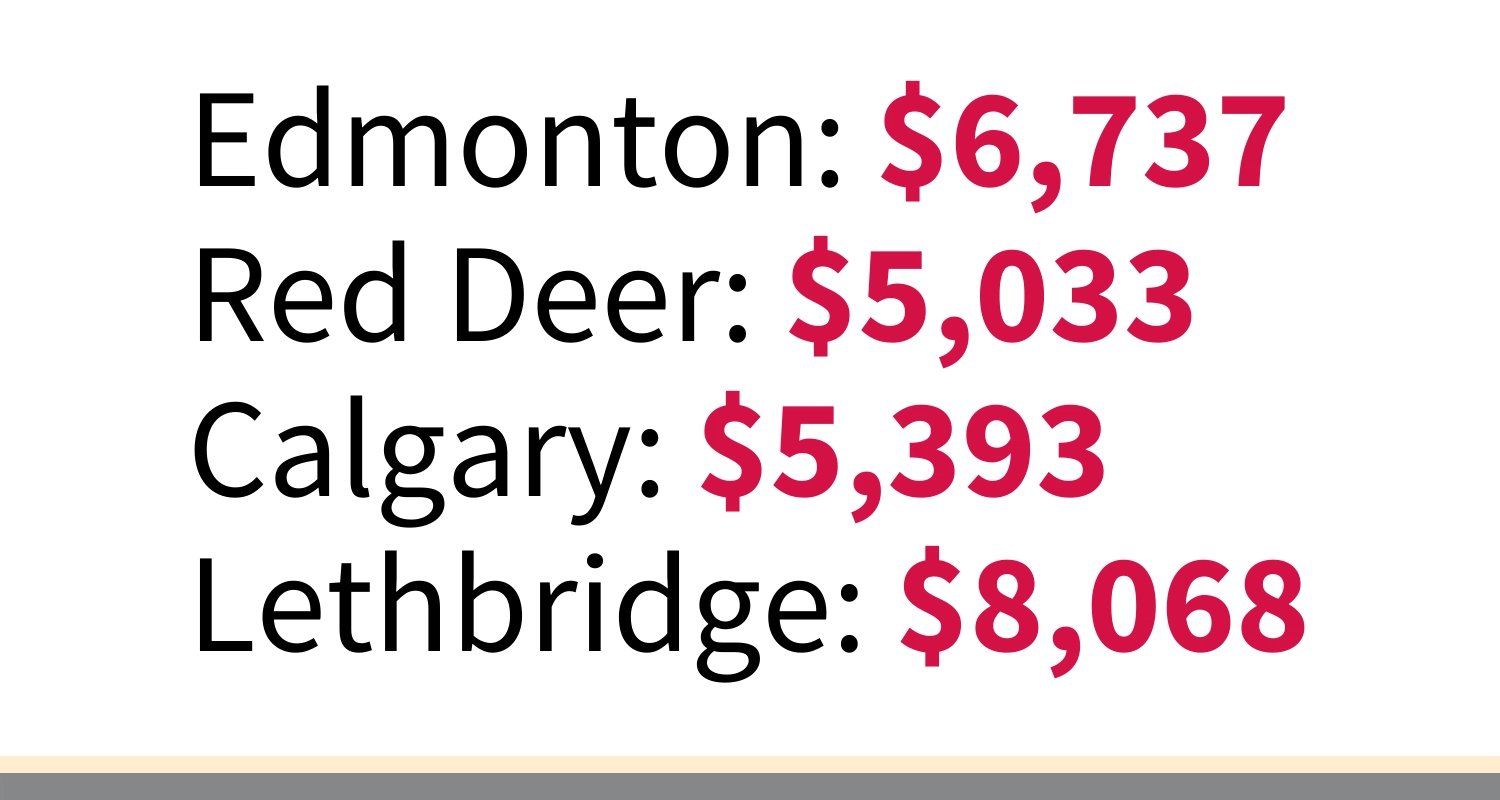

Yearly business savings if municipalities shifted 2% of the property tax share to residents:

Sign the petition

Mayor & Council

CC: My Member of Parliament

Alberta municipalities are raising property taxes to spend excessively. My small business can’t continue to keep up with rapidly increasing property taxes.

I need you to take the following action now to ensure my business can grow and our local communities thrive:

- Not introduce further cost increases (i.e. increased license and permitting fees)

- Commit to lower and fairer property taxes

- Reduce spending by finding internal efficiencies

- Have a construction mitigation plan that compensates businesses for construction-related revenue losses

- Reduce municipal red tape

- Encourage shop local campaigns

The Canadian Federation of Independent Business (CFIB) is Canada’s largest association of small and medium-sized businesses with 100,000 members across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings.